Summary:

This article shows how you can add a house to your account.

Adding houses to your account will help you:

- Track the financial aspects of the house over time

- Provide a way to calculate financial impact of switching to mortgages, or modifying existing mortgage.

Note: Mobile browsers have a simplified UI which may not contain all controls. For best experience, a desktop browser is recommended.

Steps to add a house:

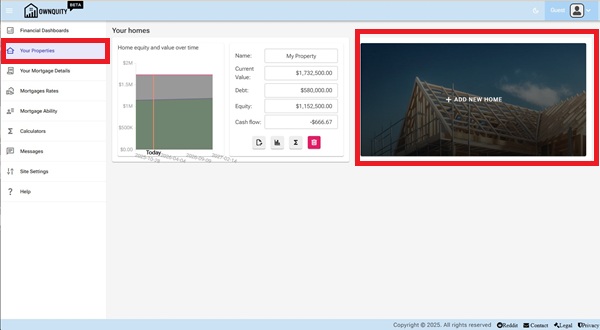

- Navigate to the "Your Properties" page using the main menu.

- Click on the "Add New Home" tile

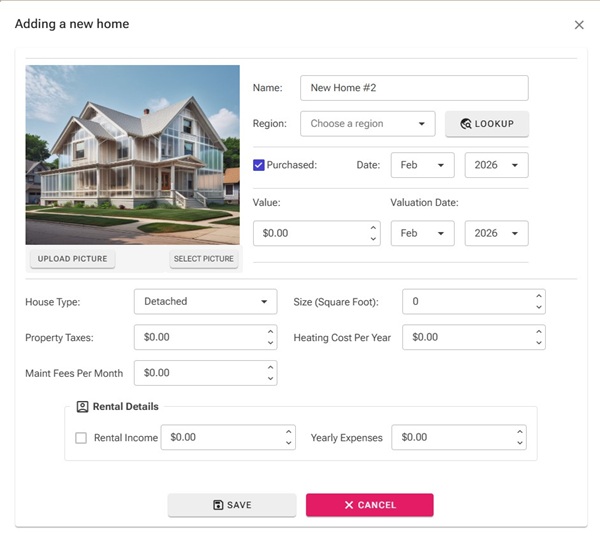

- Fill in the required details about the house in the form that appears.

- Fill In Name of the House as a quick identifier (e.g., "My First Home", "Vacation Home", etc.)

- Choose a Region of the House. This helps in calculating/Charting property value over time using the house price index data for the region.

- Fill in the purchase date. This helps in calculating/Charting property value over time.

- If House is not purchased, uncheck the purchased checkbox. This will exclude the house from your networth/equity calculations.

- Fill in the value and valuation date of the house. This works in conjunction with the house price index to track property value over time.

- Fill in the details of thse house if desired. The property Taxes, Heating Cost Per Year, Maintenance Fees Per Month are used to calculate mortgage elegibility.

- Fill in the monthly rental income if this house is (or planned to be) rented. This will be considered part of your income when performing mortgage calculations.

- Fill in the yearly expenses if there are expenses such as condo fees etc. This will be considered when calculating mortgage elegibility.

- Click the "Save" button to add the house to your account.

Additional Information:

- See Adding Mortgage article on how to add mortgages against your home.

- See Home Calculations article on what calculators are available with your home.

- See Home Chart article on how to interpret the generated charts for your home.

- See dashboard article on how to interpret the dashboards for your home equity.